Updated EMH DFS at Cinovec Project

By Sharecast

Date: Tuesday 23 Dec 2025

This announcement contains inside information for the purposes of Article 7 of the UK version of Regulation (EU) No 596/2014 which is part of UK law by virtue of the European Union (Withdrawal) Act 2018, as amended ("MAR"). Upon the publication of this announcement via a Regulatory Information Service, this inside information is now considered to be in the public domain.

European Metals Holdings Limited

(ASX & AIM: EMH, OTCQX and OTCQB: EMHXY and EMHLF)

("European Metals" or the "Company")

EMH UPDATED DFS CONFIRMS LONG-LIFE BATTERY-GRADE LITHIUM CARBONATE PRODUCER AT CINOVEC STRATEGICALLY POSITIONED TO SUPPLY EUROPEAN EV AND ENERGY-STORAGE SECTORS

Further to the announcement by the Company on 19 December 2025, and following discussions with the ASX, the DFS has been updated for the following reasons.

(1) The ASX will not permit the inclusion of the final 4 years of the production schedule thereby reducing the production schedule from 27 years to 23 years. The Company has been forced to accept this refusal despite its confidence that the production schedule as originally year disclosed in its AIM announcement of 19 December 2025 is in compliance with the JORC Code.

(2) This reduction in the mine plan has resulted in a reduction in the Pre-tax NPV8 of the Cinovec Project from 1.712bn to 1.455bn and the Pre-tax IRR from 15.3% to 14.8%.

(3) The Company is highly confident that the inferred resources in years 24-27 of the Original mine plan will be converted to indicated resources upon additional infill drilling of the inferred resources (all prior upgrades from inferred have converted 100% of the inferred resources to indicated resources) however in order to allow trading in its shares on the ASX to continue it has reduced the mine plan for the DFS to 23 Years.

(4) The Company is working with its consultants to revise the mine plan to revert to 27 years in a manner which is compliant with JORC and also with the ASX's interpretation thereof and to issue an updated DFS with these additional years included in the near future.

The updated DFS announcement is disclosed below.

HIGHLIGHTS

· Definitive Feasibility Study (DFS) confirms Cinovec as a long-life producer of battery-grade lithium carbonate, strategically located within the European EV and battery manufacturing corridor.

· Steady-state (excluding ramp up/ramp down) production of 37,500tonnes per annum (tpa) of battery-grade lithium carbonate (Li₂CO₃), representing approximately 5.2% of EU demand in 2030[1] and sufficient for up to 1,300,000 60kWh EV batteries annually[2].

· 26+ year operating life, underpinned by a JORC Resource of 747.54 Mt @ 0.19% Li (0.40% Li₂O ) (7.45 Mt LCE) and a JORC Reserve of 54.40 Mt @ 0.27% Li (0.58% Li₂O ) (145,000 t contained Li), with expansion optionality.

· Robust economics based upon the first 23 years of the full LOM 27-year production schedule: (ungeared, using flat US$26,000 lithium carbonate price)[3]

o Pre-tax NPV8%: US$1.455bn (Inclusive of Grants and exclusive of inferred resources)

o Pre-tax IRR: 14.8% (Inclusive of Grants and exclusive of inferred resources)

o LOM C1 costs: US$12,621/t;

o LOM AISC: US$13,879/t

Note: PFS price assumption for lithium carbonate is based on long term incentive price which exceeds current Chinese spot price[4]

· Initial CAPEX of US$1.72bn ((including contingency and net of approved grants) and sustaining CAPEX (life of mine) of US$0.498B.

· Significant government support: Approval for up to EUR 360m Czech Government grant + US$36m EU Just Transition Fund grant[5].

· DFS completion enables advancement of key workstreams:

o EU stakeholder engagement for additional grant and debt support

o Formal project financing discussions

o Finalisation of advanced off-take negotiations

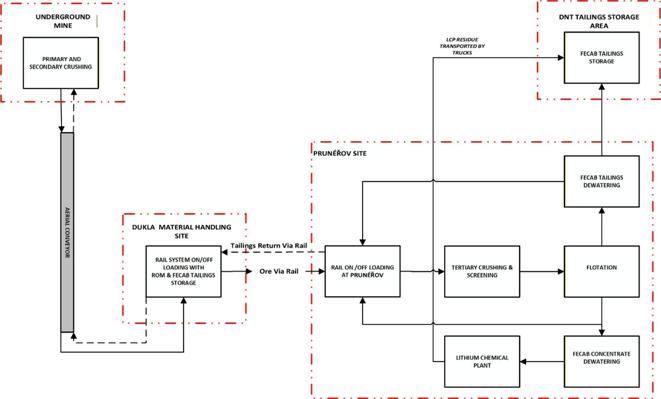

· Vertically integrated project comprising underground mine, Prunéřov beneficiation and lithium chemical plant and all necessary integration of utilities and transport requirements.

· Strong ESG profile aligned with EU CRMA, Equator Principles and International Finance Corporation standards.

European Metals Holdings Limited ("European Metals" or "the Company") announces the results of the Definitive Feasibility Study (DFS) for the Cinovec Lithium Project (Cinovec or Project), located in the Czech Republic. Cinovec hosts Europe's largest hard-rock lithium resource and one of the world's largest non-brine lithium deposits. The DFS was prepared by DRA Global (processing, including Front-End Comminution and Beneficiation (FECAB) and Lithium Chemical Plant (LCP)), Bara Consulting (mining), and specialist engineering, logistics, environmental and permitting consultants. Affiliated Czech partners, including CEZ, have also contributed extensive site, permitting, and regulatory frameworks.

The DFS builds on more than a decade of drilling and sampling, metallurgical testwork, mine design, environmental studies, permitting preparation, stakeholder engagement, infrastructure planning and engineering.

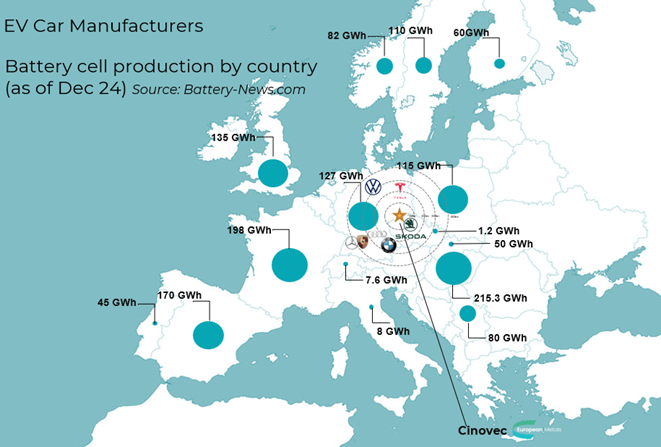

The Cinovec Project is fully located within the Czech Republic, providing EU-domestic supply of lithium to meet the continent's fast-growing requirements for EV batteries and energy-storage systems. The Project sits within 200-350 km of several gigafactories either operating, under construction, or planned within the EU and can benefit from its proximity to a large share of automotive industry entities (OEMs) in Central Europe with 22 car manufacturing plants within 400 km of Prague with over 8 million vehicles manufactured in the area annually.

Figure 1: Cinovec's location with proximity to gigafactories/OEMs either operating, under construction, or planned within the EU

Executive Chairman Keith Coughlan said:

"The DFS confirms Cinovec as one of Europe's most advanced and strategically significant lithium projects. With strong economics, central location and substantial government backing - including approval for up to EUR 360 million in Czech Government grant funding - the Project is uniquely positioned to supply long-term lithium carbonate into the European battery and EV sectors.

EMH is well placed being in partnership with CEZ, a major Czech semi-government company, and together having attracted significant European grant funding. Post this funding, the Board will continue to minimise dilution at the corporate level as it focuses on funding alternatives at the project level. Geomet, being the project company for Cinovec, will be primarily responsible for raising the early-stage funds with the majority being required towards the end of 2026. The partners are in advanced discussion with various parties with a view to provide funding to cover this requirement.

"With the DFS now released, we are advancing discussions with EU institutions regarding additional grants and strategic debt, progressing project financing with commercial lenders and potential strategic partners and moving toward the completion of off-take agreements, which are already at an advanced stage with major European battery and automotive groups. These steps collectively position Cinovec for a final investment decision."

DFS Cautionary Statement

The DFS discussed herein has been undertaken to explore the technical and economic feasibility of developing the Cinovec Lithium Project to economically and sustainably exploit the Project's Mineral Resource and Ore Reserve.

Geomet s.r.o. controls the mineral exploration licenses awarded by the Czech State over the Cinovec Lithium Project. The company is owned 49% by EMH and 51% by CEZ a.s. through its wholly owned subsidiary, SDAS. The estimated Ore Reserves and Mineral Resource underpinning the base case production target have been prepared by a Competent Person in accordance with the requirements in the JORC Code.

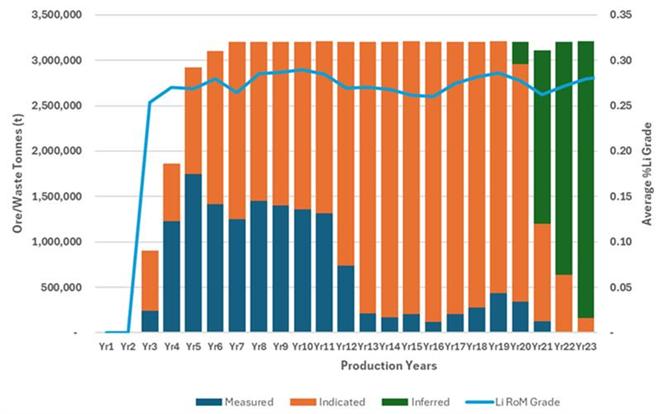

The Mineral Resource and Ore Reserve underpinning the estimated life of mine production under the DFS (production target) have been prepared by a competent person or persons and reported in accordance with the JORC 2012 Code. The entire processing schedule is set out over a period of 27 years, which comprises Measured and Indicated Mineral Resource (~75.5%) and Inferred Mineral Resource (~24.5%). The production target set out in this DFS covers the initial 23 years of the Processing Schedule and is based on 88% inventory within the Measured and Indicated Mineral Resources category, with 12% being classified within the Inferred Mineral Resources category. The Company has not included years 24 to 27 of the production schedule in the DFS as they are entirely based on inventory in the Inferred Mineral Resources category. There is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work will result in the conversion of Inferred Mineral Resources to Indicated Mineral Resources, return the same grade and tonnage distribution, or that the production target itself would be realised. Of the Mineral Resource scheduled for extraction in this production target, ~54% is classified as Probable Ore Reserve and ~19% is classified as Proved Ore Reserve. The stated production target is based on the Company's current expectations of the future results or events and should not be solely relied upon by investors when making investing decisions. Further evaluation work and appropriate studies are required to establish sufficient confidence that this target will be met. The proportion of Inferred Mineral Resource is not a determining factor for viability of the Project.

The economic outcomes associated with the DFS are based on certain assumptions made for commodity prices, concentrate treatment and recovery charges, exchange rates and other economic variables, which are not within the Company's control and subject to change from time to time. Changes in such assumptions may have a material impact on economic outcomes.

To achieve the range of outcomes indicated in the DFS, debt and equity funding will be required. THE DFS estimates that US$2.164bn in construction capital will be required. Investors should note that there is no certainty that the Geomet s.r.o. may be able to raise the amount of funding when needed and/or reach a Final Investment Decision by the date proposed in the DFS. It is also possible that such funding may only be available on terms that may be dilutive to, or otherwise affect the value of EMH's existing shares. It is also possible that Geomet s.r.o. could pursue other 'value realisation' strategies such as a sale or partial sale of the Company's share of the Project.

This announcement contains forward‐looking statements and forecast financial information. including the use of a flat US$26,000/t lithium carbonate price, the production target set out in the PFS and the financial information on which it is based. The basis for that conclusion is contained throughout this announcement and all material assumptions, including the JORC modifying factors, upon which the forward looking statements and forecast financial information are based, are disclosed in this announcement. However, such forecasts, projections and information are not a guarantee of future performance and involve unknown risks and uncertainties. Actual results and developments will almost certainly differ materially from those expressed or implied. There are a number of risks, both specific to EMH, and of a general nature, which may affect the future operating and financial performance of EMH, and the value of an investment in EMH including and not limited to title risk, renewal risk, economic conditions, stock market fluctuations, commodity demand and price movements, timing of access to infrastructure, timing of environmental approvals, regulatory risks, operational risks, reliance on key personnel, Reserve estimations, cultural resources risks, foreign currency fluctuations, and mining development, construction and commissioning risks. It should be noted that the NPV break even lithium/carbonate price is approximately US$20,500/t and that the Shanghai Metal Markets Lithium Carbonate Index (Battery Grade), delivered to China, VAT inclusive price is US$12,264/t from as at 19 November 2025

Given the uncertainties involved, investors should not make any investment decisions based solely on the results of the DFS.

INTRODUCTION & DFS BACKGROUND

The Definitive Feasibility Study (DFS) for the Cinovec Lithium Project represents the culmination of more than a decade of combined geological, metallurgical, environmental, mining and engineering work undertaken by European Metals and the project operating company, Geomet s.r.o. The DFS has been prepared by DRA Global (processing, including Front-End Comminution and Beneficiation and Lithium Chemical Plant), Bara Consulting (mining) other specialist engineering groups (Dukla bulk materials handling hub, infrastructure) and multiple Czech and international environmental, permitting and logistics consultants.

The DFS consolidates:

· Up-to-date geological interpretation supported by additional diamond drilling.

· Expanded metallurgical programs including locked-cycle flotation campaigns and sustained pilot-scale operation of the downstream lithium chemical process.

· Mine design and geotechnical modelling incorporating both historical mining data and contemporary laboratory testing.

· DFS level engineering for the aerial conveyor system, Dukla bulk materials handling hub, Prunéřov beneficiation plant (FECAB), Prunéřov Lithium Chemical Plant (LCP), backfill paste plant and Doly Nástup Tušimice open pit coal mine (DNT) tailings storage facility.

· DFS level Hydrogeological, hydrological, biodiversity, noise, vibration, air quality and visual modelling which will be utilised as part of a unified Environmental Impact Assessment (EIA).

· A full Project Execution Plan (PEP), risk assessment, cost estimation, and implementation scheduling.

The DFS demonstrates that Cinovec is technically feasible, economically robust and strategically aligned with the European Union's objectives to internalise the supply chain for battery-grade lithium chemicals. The study confirms that all components of the proposed vertically integrated operation - from underground mining through to lithium carbonate packaging - can be constructed and operated entirely within the Czech Republic, providing security of supply to European EV and energy-storage markets.

KEY PROJECT METRICS

Key Metrics |

|

|

|

| |

Measured, Indicated and Inferred Resources (Mt) | 747.54 | ||||

Proved and Probable Ore Reserves (Mt) | 54.40 | ||||

Mine Life (Years) | 22.6 | ||||

Production Life (Years) | 20.3 | ||||

Annual Crusher Feed (tonnes per annum) | 3.2M | ||||

Total Ore - Li Grade | 0.27% | ||||

Li2CO3 - Life of Mine Tonnes | 869,941 | ||||

First 5 Full Production Years | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

Ore Mined (million tonnes) | 2.54 | 2.86 | 3.20 | 3.20 | 3.21 |

Ore Grade (% Li₂O) | 0.57% | 0.59% | 0.59% | 0.59% | 0.62% |

Ore Grade (%Li) | 0.265% | 0.272% | 0.273% | 0.276% | 0.287% |

Li2CO3 Tonnes per annum | 28,824 | 33,583 | 37,580 | 38,010 | 39,747 |

Project Economics (Real) |

|

|

| ||

Costs (USD) | LOM (000's) | Li2CO3/t |

|

| |

Total C1 Costs | 9,243,496 | 12,261 | |||

All-in-Sustaining Cost | 10,164,579 | 13,879 | |||

Initial Capex | 2,164,880 | 2,489 | |||

Approved Grants (US 000's) | |||||

Combined Government and Just Transition Fund | 463,008 | ||||

Initial Capex - Grants | 1,701,872 | ||||

Sustaining Capex | 498,710 | 573 | |||

|

|

|

|

| |

Cashflow (USD) |

| With Grant |

| Without Grant | |

Price for Li2CO3 (USD /Tonne) |

| 26,000 |

| 26,000 | |

LOM Gross Revenue (000's) | 19,042,009 | 19,042,009 | |||

LOM EBITDA (000's) | 9,353,777 | 9,353,777 | |||

Pre Tax NPV (8% Disc. Rate) (000's) | 1,455,368 | 1,087,897 | |||

Pre Tax IRR (8% Disc. Rate) | 14.8% | 12.5% | |||

Post Tax NPV (8% Disc. Rate) (000's) | 929,396 | 596,113 | |||

Post Tax IRR (8% Disc. Rate) | 12.7% | 10.7% | |||

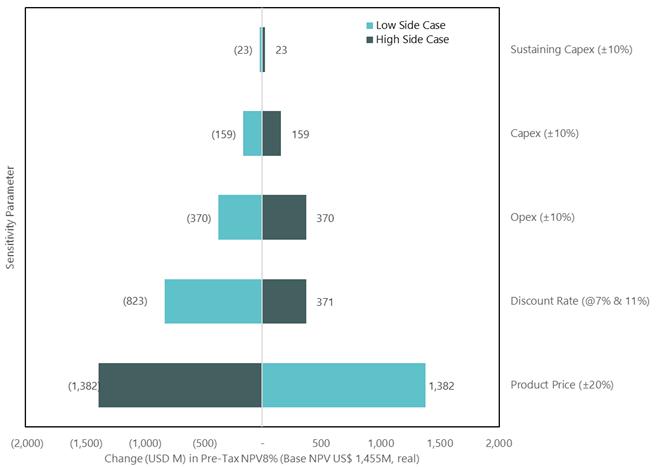

Sensitivity Analysis Results

Figure 2 - Sensitivity Analysis Tornado

Multiple hypothetical scenarios have been considered for analysing the impact to project NPV (@ 8% post- tax, nominal) by adjusting selected critical assumptions and cost inputs within a given range. The sensitivity analyses have been performed using a post-tax (nominal) discount rate of 8% with each variable as follows flexed ±X% using the midpoint price range applied as the central case. The central case assumes a Lithium Carbonate price of US$26,000/t real and results in an NPV of US$1,715M at an 8% pre-tax, nominal discount rate, with grant allowances included.

Figure 3 Graph of the mine production profile by resource category

Project Funding Sources and Strategy

EMH is well placed being in partnership with CEZ, a major Czech semi-government company, and together having attracted significant European grant funding. Post this funding, the Board will continue to minimalise dilution at the corporate level as it focuses on funding alternatives at the project level. Geomet, being the project company for Cinovec, will be primarily responsible for raising the early stage funds with the majority being required towards the end of 2026. The partners are in advanced discussion with various parties with a view to provide funding to cover this requirement.

Given the technical and economic viability demonstrated by the Feasibility Study, the Company has reasonable grounds to believe the Project could be financed via a combination of debt and equity.

Following the completion of the DFS, the Company will seek to formalise the ongoing discussions with potential debt or equity institutions. The Company expects debt could potentially be secured from a range of sources including European banks (eg EIB/KFW), Australian banks, European critical minerals funds, resource credit funds, export credit agencies, Government agencies and in conjunction with product sales or offtake agreements. The viability of the Project is enhanced by having a joint venture partner in the CEZ Group and the very clear political and economic support of the Czech Government and European Union, which will assist in negotiations for debt and equity.

The Company may also consider commencing a formal strategic partnering process whereby alternative funding options, including undertaking a corporate transaction, a joint venture partnership, a partial asset sale and/or offtake pre-payment could be undertaken if it maximises shareholder value over the long term.

The Company has maintained close contact with a number of potential offtakers in Europe and globally during the course of development of the DFS. Discussions with these parties will now be formalised.

The support of the Czech Government in the grant award is confirmation that the Cinovec Project is a foundation stone enabling the development of downstream industries, expected to bring significant industrial partners to invest in Czechia, whether in the Cinovec Project itself or the enabled Pre-CAM, CAM, Li-ion battery or BEV industries.

There is no certainty that the Company will be able to source funding as and when required. It is also possible that required funding may only be available on terms that may be dilutive to or otherwise affect the value of the Company's existing shares.

The Company has formed the view that there is a reasonable basis to believe that requisite future funding for development of the Project will be available when required based on the following:

· EMH has a market capitalisation of approximately A$80 million and a strong track record of raising equity funding for the advancement of the Project. Approximately A$61.7M has been raised from sophisticated investors, brokers and existing shareholders, and used to advance its share of the Cinovec project;

· The Project is Critical to European critical mineral security, with proven mining and straightforward processing methods and, once in operation, will be a significant source of lithium carbonate outside China;

· Demand growth for lithium is expected to be strong and funding for high-quality resource projects delivering production of this metal is likely to be available. The Project has the potential to become a top-tier lithium carbonate producer within the EU and provide a strategically certain supply of lithium carbonate to gigafactories and OEM automotive suppliers all located within the European jurisdiction, which is expected to attract a range of financiers and partners;

· Economic viability at this early stage of the Project, in a range of scenarios, has been demonstrated by strong free cashflow and a capital investment payback period of 7 years as outlined in the Feasibility Study.

· Vulcan Energy has recently completed a fund raising for a lithium battery metal project of similar size and with a similar NPV and was able to attract a debt package of €1,185m (A$2,116m) in senior debt funding by a syndicate of 13 financial institutions comprising the European Investment Bank, five Export Credit Agencies and seven commercial banks.

· Vulcan Energy also raised:

(1) €204m in German government grants

(2) €150m equity investment in Vulcan's primary German holding subsidiary, Vulcan Energie Ressourcen GmbH (GermanSubCo), by the KfW Raw Materials Fund (KfW) to acquire a 14% interest in GermanSubCo

(3) €133m investment by a consortium of strategic investors comprising HOCHTIEF, Siemens Financial Services and Demeter to acquire a 15% equity interest in the Phase One Lionheart project entity With HOCHTIEF and Siemen being involved in the construction and development of the Project.

NEXT STEPS

With the DFS now complete, European Metals will proceed with the following key workstreams and accelerate Cinovec's development:

EU & Czech Government Engagement

The Company will advance discussions regarding:

· Additional EU-level grant funding

· Strategic debt facilities from European Investment Bank (EIB), Export Credit Agencies (ECAs) and other supranational lenders

· Access to Critical Raw Materials Act (CRMA)-backed financing mechanisms

· Czech co-funding structures and regional development incentives

Project Financing

The DFS provides the foundation for:

· Formal engagement with commercial lenders

· Due diligence by commercial lenders, EIB, ECAs and other supranational lenders

· Evaluation of strategic partners for equity and project-level funding

· Financial structuring scenarios that optimise cost of capital

Off-Take Agreements

The Company is engaged in advanced discussions with:

· Major Czech and European battery manufacturers

· Cathode active material producers

· Automotive OEMs

With DFS parameters finalised, these discussions will progress to:

· Binding term sheets

· Volumetric commitments

· Multi-year supply agreements

· Technical qualification programmes

Environmental & Permitting

· Submission of the Unified EIA

· Finalisation of land-use and construction permits for all sites

· Finalisation of water, waste, air, and operational approvals

· Ongoing Natura 2000 and Protected Landscape Area consultations

Cinovec's location within the EU provides a significant competitive advantage for off-take partners seeking secure domestic supply.

Preparation for Final Investment Decision (FID)

FID-enabling activities include:

· Completion of front-end engineering and design (FEED) (including contract for EPCM partner)

· Early works packages (clearing, utilities, geotechnical groundwork)

· Contractor prequalification

· Detailed project execution modelling

· Completion of full financing package

DFS OVERVIEW

PROJECT LOCATION & STRATEGIC CONTEXT

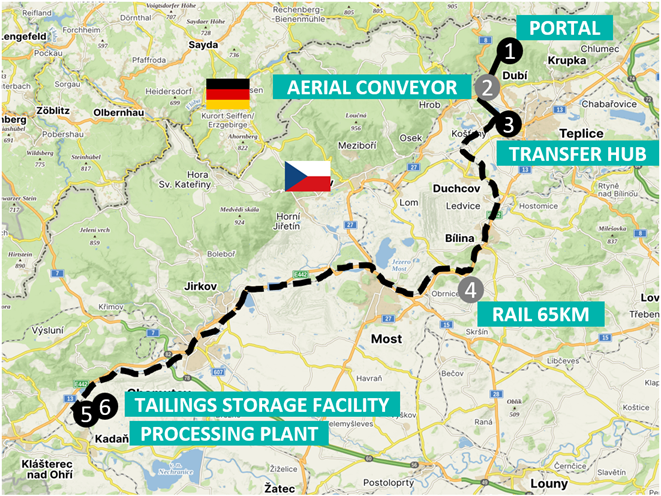

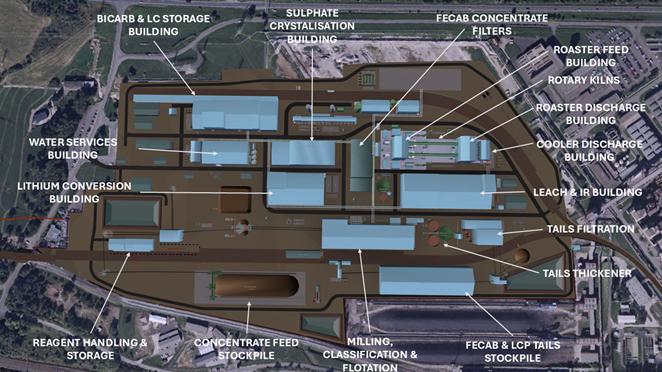

Cinovec is located in the Ústí nad Labem Region of northern Czech Republic, near the German border, and within 200-350 km of multiple operating or announced European gigafactories. The Project in its entirety comprises of 6 distinctive interconnected elements, (See Figure 3) namely:

1. Underground mine and associated surface infrastructure at a portal site, located close to Cinovec village on the Czechia / German border.

2. Aerial Conveyor System (ACS) ore transportation link running approximately 7.3km between the mine portal and an ore transfer station located at Dukla.

3. Transfer station located at the Dukla industrial site where ore is transferred from the ACS to rail and tailings material from the processing plant, destined for backfill into the mine, is transferred to the ACS to be returned to the backfill paste plant at the mine portal.

4. Rail link running 65 km between the transfer station and the processing plant.

5. The processing plant at Prunerov.

6. Tailings disposal site located on previously mined land at the Doly Nástup Tušimice coal mine (DNT) approximately 7.5km (via road) to the east of the processing plant.

The Project is positioned in one of Europe's most industrially developed regions, offering:

· Mining construction, engineering and existing heavy industrial infrastructure and skills base experience.

· Strong rail, road, water and energy infrastructure.

· Proximity to major EV and battery manufacturing projects in Germany and Central and Eastern Europe.

· Supportive state and municipal frameworks, with the Czech Republic designating Cinovec as a Strategic Deposit.

· EU-level support through the CRMA, recognising Cinovec as a Strategic Project[6].

Cinovec therefore sits at the nexus of supply, demand and policy alignment. Its location reduces logistics risk, minimises shipment emissions, and positions the Project as a cornerstone of Europe's push to secure critical minerals within the EU.

Figure 4: Cinovec's key project components

GEOLOGY & MINERALISATION

Geological Setting

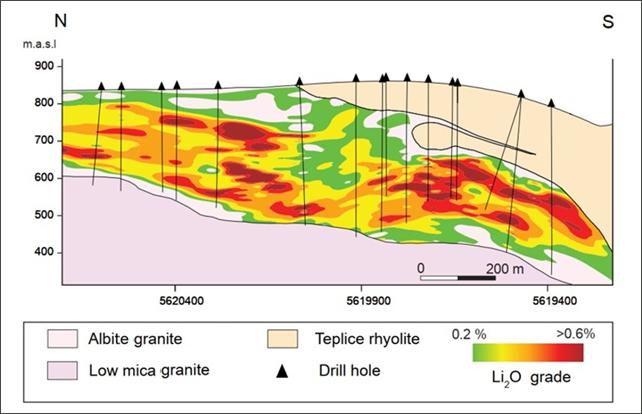

Cinovec is a greisen-hosted lithium mica deposit formed within a series of granitic intrusions. The lithium mineralisation occurs primarily within zinnwaldite-rich greisen zones that exhibit:

· Broad lateral continuity

· Significant thicknesses (commonly 20-100 m)

· Predictable mineralogical behaviour

· Favourable geotechnical conditions for large-scale underground mining

Figure 5: Longitudinal Section across the Cínovec deposit

Historical Mining

Cinovec has a long industrial history. Late 20th-century test-mining for tin in the massive Cinovec orebody extracted approximately 400,000 tonnes of lithium-bearing tin ore from small-scale test stopes, after the high tin grade hydrothermal veins coming off the massive orebody had been largely exhausted over the previous decades. This has left a legacy of drives, stopes and chambers and a wealth of geological data. The historical workings have provided:

· Real-world geotechnical validation

· Empirical data for rock-mass behaviour

· Proven suitability of Sub-Level Open Stoping (SLOS)

These historical data sets significantly reduce uncertainty in the DFS mine design. The planned mine production will not mine through these historical areas, which are located above the DFS mining levels.

Mineralogical Characteristics

The dominant lithium mineral is zinnwaldite, a lithium-bearing mica with consistent metallurgical behaviour. The DFS incorporates extensive mineralogical characterisation to:

· Define metallurgical domains

· Predict flotation and LCP response

· Support recovery assumptions across the mine life

RESOURCE MODEL & RESERVE BASIS

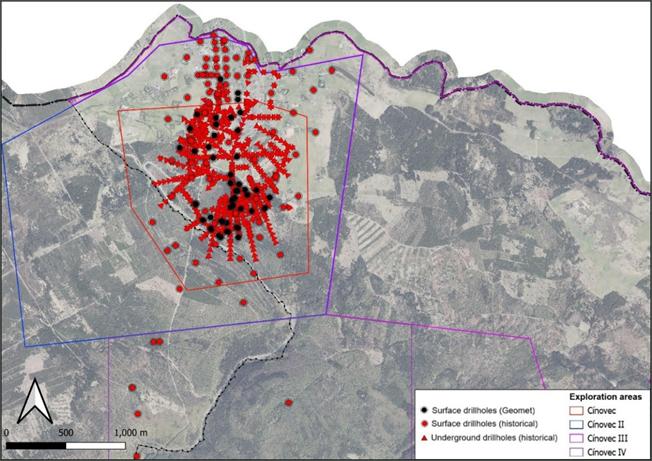

Drilling & Data Inputs

The DFS incorporates data from:

· Historical drilling

· Extensive new drilling by European Metals

· Underground sampling from historical workings

· 8.5 tonnes of bulk metallurgical samples for FECAB testwork and LCP pilot campaigns

The dataset supports a high-confidence geological and resource model.

Figure 6: Locations of the drilling at Cinovec on aerial map

Resource Estimate

The DFS Mineral Resource estimate comprises:

· 748 Mt @ 0.19% Li

· Containing 7.45 Mt LCE

A substantial portion is classified as Measured or Indicated, supporting DFS-level mining and processing assumptions.

Ore Reserve

The DFS mine plan is underpinned by a robust Ore Reserve that supports production in the first 22 years of the full LOM 26-year operating schedule (which included the inferred resources). Additional blocks defined within the Resource but not yet incorporated into the Reserve represent clear expansion potential beyond the base case.

Reserve estimation incorporates:

· Geotechnical constraints

· Mining method and design envelopes

· Mining modifying factors

· Metallurgical recoveries

· Economic cut-off grade modelling

Supporting Metallurgical Testwork

Extensive metallurgical testwork using core and development rock to support and validate:

· Mineralogy, lithology and liberation properties

· Comminution characteristics

· Flotation separation efficiency in terms of concentrate grade and lithium recoveries

· Dewatering of concentrates and tailings

Bulk core samples from drilling were processed to produce sufficient concentrate for downstream pilot testwork, validating:

· LCP extraction efficiency

· Impurity deportment characteristics

This metallurgical dataset provides the technical foundation for both the beneficiation (FECAB) and LCP recovery assumptions adopted in the DFS.

MINING ENGINEERING & MINE DESIGN

The DFS mine design reflects the combined geological, geotechnical and operational characteristics of the Cinovec deposit. The study adopts SLOS with cemented paste-fill, supported by a robust geotechnical model informed by laboratory testing, historical mining data and numerical simulation.

Mining Method Selection

SLOS was selected following evaluation of multiple underground mining methods including room-and-pillar, cut-and-fill and drift-and-fill. Key reasons for selecting SLOS include:

· Orebody geometry: Cinovec's thick, laterally continuous greisen zones are highly suited to bulk, long-hole stoping.

· Rock mass competency: Laboratory and in situ testing confirm favourable rock-mass conditions.

· Historical mine performance: Previous workings used variants of sub-level stoping with strong stability outcomes.

· Productivity & cost: SLOS achieves the required mining rate of ~3.2 Mtpa at competitive operating cost.

· Paste-fill compatibility: Large voids created by SLOS can be safely backfilled, enabling high extraction and geotechnical stability.

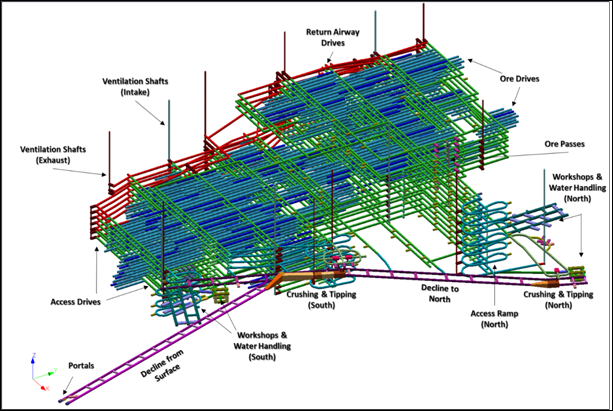

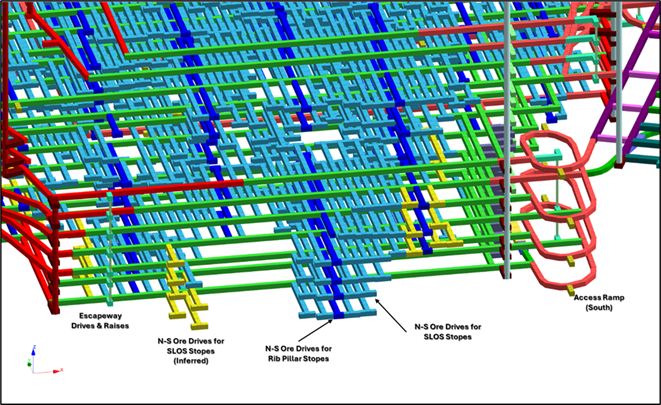

Figure 7: Underground Infrastructure - Looking North-Northeast

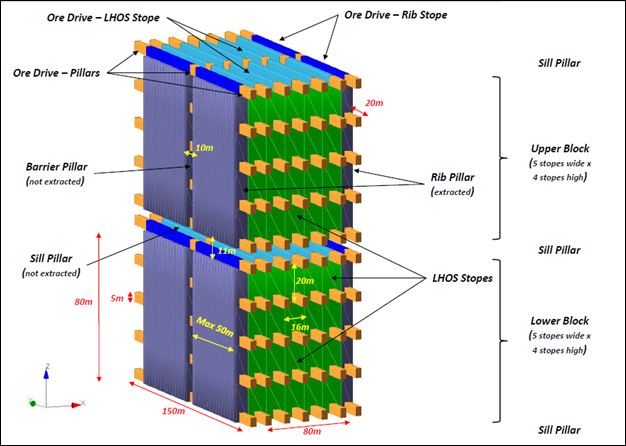

Stope Geometry & Design Parameters

Standard stope dimensions are optimised for stability, productivity and minimal dilution.

· Stope height: 20 m

· Stope width: 16 m

· Stope length: Up to 50 m

· Mining blocks: Four stopes vertically × five stopes horizontally, forming 80 × 80 m blocks

· Rib pillars: 10 m

· Sill pillars: 6 m (11 m total with ore access drives)

Figure 8: Nominal Sub-Level Stope Block & Pillar Arrangement

Mini-SLOS Stopes

Certain mineralised zones require reduced stope height to maintain stability and improve recovery:

· Height: 7 m

· Application: Flatter or thinner ore zones

· Outcome: Increased recovery of marginal domains without compromising safety

Mine Layout & Infrastructure

The mine is accessed via a Twin Decline System:

· One decline dedicated to vehicle access, services, water, power distribution, ventilation intake

· One decline dedicated to the conveyor, forming the mine's primary materials handling backbone

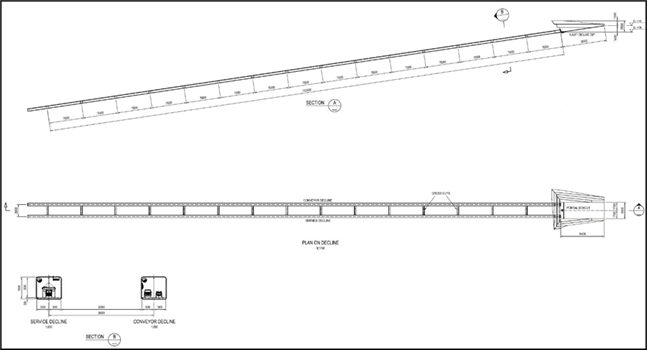

Figure 9: Twin decline system

Internal Mine Development

· Spiral ramps accessing multiple mining horizons

· Ore drives positioned on sub-levels

· Cross-cuts enabling multiple operating fronts

· Ventilation raises and emergency egress

Figure 10: Access ramps / Drives and LHOS / Rib Pillar Ore Drives

Ventilation & Airflow Modelling

The mine uses a push-pull ventilation system designed to:

· Maintain statutory airflow

· Control dust and diesel particulates

· Provide redundancy for fan outages

· Operate under varying seasonal temperature conditions

Computational fluid dynamics (CFD) modelling is integrated into the DFS.

Production Schedule

The DFS production plan is structured to provide:

· Early development ore for commissioning

· Ramp-up to full production over multiple years

· Steady-state ore production: ~3.2 Mtpa

· Multiple mining fronts to maintain schedule resilience

· Optimised sequencing for geotechnical stability and paste-fill curing

Paste-fill System

Paste-fill forms a critical part of the mine design.

Paste-fill characteristics:

· Blend of tailings, cement and water

· Engineered to achieve required strength and curing performance

· Returned underground via the rail and subsequently via the aerial conveyor system

Benefits:

· Maximises ore extraction

· Minimises surface tailings footprint

· Enhances ground stability

· Reduces long-term geotechnical risk

MATERIALS HANDLING & LOGISTICS

Cinovec employs an integrated materials-handling system linking underground operations with surface processing infrastructure.

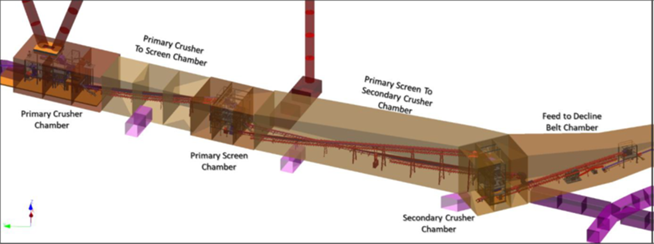

Underground Crushing & Conveyor Feed

Primary and secondary crushing underground reduces ore to <83 mm, enabling efficient feeding to the conveyor decline. Benefits include:

· Reduced truck traffic

· Lower diesel consumption

· Reduced dust and noise

· More consistent feed to the Aerial Conveyor System

Figure 11: Underground Crushing Arrangement within Crushing Chambers

Aerial Conveyor System

A defining feature of Cinovec is the bi-directional aerial conveyor, engineered to transport ore from the mine portal to Dukla and return tailings materials to the backfill paste plant at the mine portal area.

Engineering Characteristics

· Designed for operation in snow, ice and high winds

· Tower spacing optimised for topography and visual impact

· Low-noise drive systems

· Enclosed belt structure to minimise dust

· Passive and active environmental controls

Environmental Advantages

· Eliminates heavy trucking through local villages

· Reduces emissions and traffic congestion

· Minimises ground disturbance

· Aligns with Natura 2000 and Protected Landscape Area constraints

Figure 12: Aerial Conveyor example

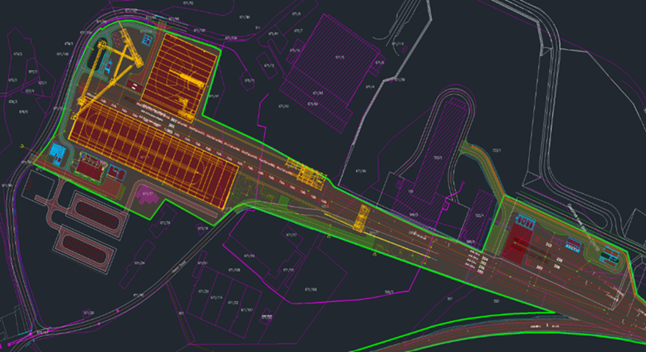

Dukla Materials Handling Hub

Dukla is the operational centre for ore and tailings backfill receipt, stockpiling and rail transport.

Features:

· Large Run of Mine (ROM) and tailings stockpiles

· Bucket-wheel reclaimer for consistent blending

· Rail loadout system sized for the Prunéřov processing rate

· Tailings reception system feeding the Aerial Conveyor System (ACS)

· Water and utility infrastructure

Dukla's location leverages existing industrial permissions and rail infrastructure, lowering both CAPEX and permitting complexity.

Rail Logistics

Ore is transported ~65 km to Prunéřov via existing freight rail networks.

Benefits:

· Low emissions

· Predictable year-round operation

· Quiet and low-impact compared to road haulage

· Leverages established Czech rail infrastructure

Figure 13: Plan view of the Dukla site

Figure 14: Aerial view of Dukla

PROCESSING - FRONT-END COMMINUTION & BENEFICIATION (FECAB)

The Cinovec beneficiation flowsheet has been refined over several years of laboratory testing.

Comminution Circuit

The FECAB plant comprises:

· Underground crushing (<83 mm)

· Surface tertiary crushing and screening

· Rod milling to achieve optimal liberation with minimal slimes, and classification

· Desliming to prepare feed for flotation

Beneficiation Circuit

Flotation is the primary method selected for concentrating zinnwaldite. The circuit includes:

· Rougher flotation

· Two stages of cleaning flotation

· Scavenger flotation stages to optimise recovery

· Concentrate thickening and filtration

· Tailings thickening and filtration

DFS testing demonstrates:

· Flotation has high selectivity for Zinnwaldite, hence efficient concentration

· Consistent high purity concentrate grades: >1.44% Li

· Concentrate mass yields of 17-20% (in terms of ROM) realising a 5 times mass reduction

· Stable FECAB lithium recoveries: >89%

Figure 15: Flotation Process

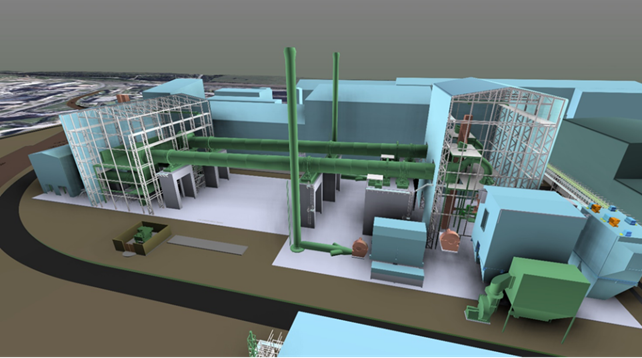

PROCESSING - LITHIUM CHEMICAL PLANT

The LCP comprises:

· Mixing of concentrate with simple roast reagents gypsum, limestone, recycled alkali sulphates

· Pellet extrusion, roasting for 1 hour at 925°C and water leach at 60°C

· Impurity removal steps - transition metals, calcium

· Lithium phosphate precipitation and dissolution to give lithium sulphate solution

· Glauber's salt crystallisation to give minor by-product stream and alkali sulphates to recycle to roast

· Crude lithium precipitation

· Bicarbonation and micronisation to give battery-grade lithium carbonate

DFS testing demonstrates:

· Consistent battery grade lithium carbonate meeting current international standards

· Stable LCP lithium recoveries: ~91%

· Reliable performance across metallurgical domains

Figure 16: Aerial View of the Processing plant complex at Prunerov

Combined FECAB and LCP testwork supports an overall lithium recovery of approximately 80.7% into battery-grade lithium carbonate, consistent with the DFS flowsheet design.

Figure 17: LCP - Rotary Kilns

Flowsheet Evolution & Testwork

Earlier flowsheets included WHIMS (magnetic separation). However, systematic testwork showed:

· WHIMS performance declines with fines (<150 µm)

· Overall recovery improves with flotation-only flowsheets

· Simpler flowsheet reduces CAPEX and OPEX

Subsequent laboratory testwork including locked-cycle flotation validated the final flowsheet.

Concentrate Quality & Handling

The final concentrate is:

· Dewatered to specification

· Stockpiled at Prunéřov

· Fed directly into the LCP roasting step

Variability testing confirms suitable performance across head grades ranging from ~0.19% to ~0.35% Li.

Figure 18: Overall Process Schematic

ENVIRONMENTAL, SOCIAL & GOVERNANCE (ESG)

The DFS embeds ESG principles across all mine, transport, and processing design elements. Cinovec has been structured to meet or exceed the requirements of:

· Czech national and regional environmental laws

· EU CRMA

· International Finance Corporation Performance Standards

· Equator Principles

· EBRD Environmental & Social Guidelines

ESG considerations have shaped process flowsheet selection, materials handling design, logistics routing, energy sourcing, community engagement, closure planning, and environmental monitoring systems.

Environmental Impact Assessment (Unified EIA)

Cinovec is progressing a unified and fully integrated Environmental Impact Assessment, covering all major project components and expected to be submitted in December 2025. it covers:

· Underground mine

· Aerial Conveyor System

· Dukla materials handling and rail hub

· Prunéřov FECAB and LCP complexes

· DNT tailings and backfill facility

A single EIA reduces duplication, streamlines regulatory oversight, and ensures cumulative impacts are assessed holistically.

Key EIA components include:

· Air quality & dust modelling

· Noise & vibration modelling

· Visual and landscape assessments

· Biodiversity surveys and habitat mapping

· Water quality modelling

· Groundwater interactions

· Waste, effluent and spill management plans

· Natura 2000 compliance assessment

Biodiversity & Natura 2000 Compatibility

Cinovec occurs near areas of biodiversity sensitivity, including:

· Natura 2000 sites (protected habitats under EU law)

· Spa-regions with protected water resources

· Landscapes under conservation designation

DFS-aligned environmental management measures include:

· No surface mining

· Minimised land clearing and disturbed footprint

· ACS alignment refined to avoid harm to protected zones

· Enclosed conveyor system to eliminate dust and reduce noise

· Wildlife movement corridors maintained

· Detailed flora and fauna baseline surveys completed

The DFS concludes the Project can operate without unacceptable impacts on Natura 2000 values.

Air Quality, Noise, and Vibration

Air Quality

Use of enclosed conveyors, underground crushing and rail transport significantly reduces dust emissions. Prunéřov's existing industrial monitoring infrastructure supports continuous air-quality assessment.

Noise

Noise modelling confirms compliance with Czech and EU thresholds at residential receptors. Key controls include:

· Low-noise conveyor drives

· Acoustic shielding

· Rail-loadout timing restrictions (if required)

Vibration

Modelling covers blasting, ACS tower construction and rail operations. Peak vibration levels are well within regulatory limits.

Water Management & Hydrogeology

DFS hydrological and hydrogeological studies confirm:

· Minimal interaction between mine voids and regional aquifers

· Water balance managed through closed-loop systems

· Non-contact water diverted away from operational areas

· Lined systems at Dukla, Prunéřov and DNT to control seepage

· Treatment plants comply with Czech water discharge standards

Tailings that are not reused as underground paste-fill will be stored in a designed filtered dry-stack facility at DNT, further reducing the Project's long-term surface footprint.

Protection of spa water systems - a critical regional concern - is fully incorporated into the DFS and EIA.

Social Impact & Stakeholder Engagement

Selection of the Prunéřov processing complex followed extensive community and stakeholder consultation, with the location optimised to minimise impacts on inhabited areas.

European Metals and Geomet have conducted extensive engagement over several years with:

· 17 municipalities

· Spa-town authorities (Teplice, Dubí)

· Regional Ústí nad Labem authorities

· National ministries (Industry & Trade, Environment, Transport, Finance)

· Local community representatives

· Environmental groups

· Transport and infrastructure agencies

Key outcomes include:

· Route optimisation for ACS to avoid sensitive viewpoints

· Traffic minimisation through elimination of ore haulage trucks

· Information centres and consultation sessions

· Integration of local employment and supply-chain development plans

Climate, Carbon & Energy Strategy

Cinovec's design reduces carbon intensity through:

· Elimination of diesel truck haulage

· Rail-based logistics

· Underground crushing and conveying

· Ability to utilise increasing Czech grid renewable penetration

· Energy-efficient roasting and drying systems

· Waste heat recovery opportunities

A ISO-compliant lifecycle assessment is being finalised for the EIA.

PERMITTING, APPROVALS & GOVERNANCE

Cinovec benefits from streamlined approvals pathways due to its designation as:

· A Strategic Project under the EU CRMA

· A Strategic Deposit under Czech law

These classifications support accelerated permitting, access to EU funding structures, priority regulatory engagement and governance stability.

Permitting Framework

The Project requires the following major approvals:

1. Unified EIA approval

2. Land-use and zoning confirmations

3. Construction permits (mine, ACS, Dukla, Prunéřov, DNT)

4. Mining licence and extraction permit

5. Rail-loading and transport licences

6. Air, water, and waste management permits

7. Operational safety approvals

The EIA is the critical path approval, with all other major permits contingent on its issuance.

Government Support

The Project has received:

· Approval for up to EUR 360m from the Czech Government, representing up to 26% of eligible capital costs.

· US$36m grant from the EU JTF, targeted toward regional economic transformation.

Additional EU-level debt or hybrid instruments may be available through:

· EIB

· ECAs

· European Commission's Innovation Fund

DFS completion enables formal engagement with these institutions.

EU CRMA

The Project has been formally recognised by the European Commission under the CRMA, enabling streamlined permitting pathways and reinforcing the Project's importance to Europe's battery supply chain.

Cinovec's CRMA designation provides:

· Accelerated permitting timelines

· Access to strategic funding structures

· Priority regulatory processing

· Enhanced visibility among EU industry and policy groups

· Recognition as a project of "strategic importance for green transition"

Governance & Risk Management

DFS includes a full Quantitative Risk Assessment (QRA) covering:

· Technical risks

· Schedule risks

· Market risks

· Environmental and permitting risks

· Operational readiness

· Supply chain and workforce availability

Mitigation measures include:

· Staged procurement planning

· Early works design packages

· All-season construction methodologies

· Redundancy in critical equipment

· Conservative ramp-up modelling

ECONOMIC RESULTS & FINANCIAL ANALYSIS

The DFS demonstrates strong economic outcomes with a long-life, low-cost operation and substantial revenue potential.

Key DFS Economic Outcomes

· Pre-tax NPV (8%): US$1.455bn (Post-tax NPV: US$929m) (inclusive of approved Grants but exclusive of inferred resources)

· Pre-tax IRR: 14.8% (Post-tax IRR: 12.7%)(inclusive of approved Grants but exclusive of inferred resources)

· Payback period: ~7 years starting from production start date

· LOM Revenue: US$19,042bn

· LOM C1 Costs: US$12,621/t Li₂CO₃

· LOM AISC: US$13,879/t Li₂CO₃

· Initial CAPEX US$2.164bn; Sustaining CAPEX US$0.498bn (inclusive of contingency) but excluding Grants (Initial CAPEX US$1.72bn net of Approved Grants)

Capital Cost Breakdown

CAPEX includes:

· Underground mine development

· ACS construction and instrumentation

· Dukla foundations, stockpiling and rail-loadout infrastructure

· FECAB plant build at Prunéřov

· LCP construction

· DNT facility earthworks, lining, pumping and monitoring

· Power, water, gas and access infrastructure

· Owner's costs, EPCM (engineering, procurement and construction management), spares, commissioning and contingency

Grant support (Czech Government + EU Just Transition Fund (JTF)) significantly reduces net capital requirements.

Operating Cost Structure

OPEX is driven by:

· Mine production and maintenance

· Paste-fill operations

· ACS power consumption

· Rail logistics

· FECAB reagent and comminution costs

· LCP roasting, leaching and purification reagents

· Labour, utilities, and general and administrative costs

Cinovec's OPEX reflects:

· Short logistics distances

· Efficient rail utilisation

· No truck haulage

· Use of existing industrial land at Prunéřov

· Stable power and water costs in Czech Republic

Product Marketing & Off-Take Position

European Metals is in advanced negotiations with major:

· European battery manufacturers

· Cathode producers

· Automotive OEMs

DFS completion enables conversion of these discussions into binding off-take agreements.

Funding and Strategic Partnerships

DFS-level financial modelling supports engagement with:

· EU institutions offering strategic debt

· ECAs

· Commercial banks

· Potential strategic equity partners

· Government-backed lending instruments

The Project's CRMA classification is a critical enabler of funding optionality.

PROJECT EXECUTION PLAN

The DFS defines an execution schedule commencing in early 2026, with underground development, ACS and Dukla construction and Prunéřov FECAB/LCP builds sequenced through to integrated commissioning in 2031.

Construction Strategy

Cinovec adopts a multi-stage construction approach designed to:

· Minimise schedule risk

· Enable early works to accelerate project readiness

· Align commissioning across multiple sites

· Utilise regional contractors familiar with industrial builds

Major execution components:

1. Underground Mine Development

o Advance declines and establish the primary conveyor drive chambers

o Install early ventilation infrastructure

o Develop initial stoping panels for commissioning ore

2. Aerial Conveyor System (ACS) Construction

o Tower-by-tower foundation installation

o Cable-stringing and mechanical installation

o Winterisation and all-weather performance validation

3. Dukla Hub Construction

o Groundworks and utility relocation (including gas pipeline adjustments)

o ROM pad creation and reclaimer installation

o Rail siding and loadout system construction

4. Prunéřov Beneficiation (FECAB) & LCP Construction

o Site clearing and regrading

o Shared utilities build-out

o Sequential construction of FECAB followed by LCP

o Integrated commissioning plan

5. DNT Tailings Facility Preparation

o Void shaping and lining

o Construction of return-water, drainage and monitoring systems

o Paste-fill distribution lines

Procurement & Contracting Strategy

Procurement is structured to balance local participation with the delivery certainty of international OEMs.

DFS-aligned procurement approach:

· Long-lead items (kilns, mills, flotation cells, crystallisers) prioritised for early commitment

· Modularisation of key structures to speed on-site assembly

· Local Czech contractors used for civil works, electrical, mechanical installation and site utilities

· Competitive tendering across all major plant packages

· Framework agreements for reagents, maintenance consumables and spare parts

This strategy reduces schedule bottlenecks, enhances local content, and supports stable long-term operations.

Workforce & Training Strategy

DFS modelling incorporates:

· Required workforce of ~1,200 direct construction jobs

· ~700 operational roles across mining, processing, logistics, laboratory, maintenance and administration

· Targeted hiring from local municipalities

· Specialist training programmes for LCP operations

· Partnerships with regional technical universities and vocational schools

Operational Readiness & Ramp-Up

The DFS includes a detailed project schedule:

· Commissioning of FECAB to deliver consistent concentrate feed

· Stepwise activation of LCP roasting, leaching, purification and crystallisation circuits

· Achievement of design throughput over a multi-year ramp-up period

· Multi-front mining approach ensuring reliable feed to processing operations

Risk Management & QRA Outcomes

A full QRA covers technical, economic, environmental, and execution risks.

Mitigations incorporated into the DFS include:

· Conservative equipment sizing and redundancy

· Detailed geotechnical modelling

· Advanced ACS climatic modelling (icing, snow load, wind)

· Multisource power stability analysis

· Supply-chain redundancy for critical reagents

· Construction season planning for winter conditions

· Flexible scheduling to accommodate EIA timing risks

CLOSING STATEMENT

The Definitive Feasibility Study confirms Cinovec as a long-life, high output and strategically important lithium project capable of delivering substantial volumes of battery-grade lithium carbonate into the European supply chain.

Cinovec's combination of:

· Scale and longevity

· Robust economics

· Proximity to EU gigafactories

· Vertically integrated design

· Strong government and regulatory support

· Advanced off-take and funding discussions

positions it as one of the most strategically significant lithium developments globally.

European Metals will continue to work closely with its stakeholders, regulatory authorities, EU institutions, financing partners and future customers to advance the Project towards construction and production.

DFS -SUMMARY

The summary of the DFS and JORC Table is contained in the following link:

ENDS

This announcement has been approved for release by the Board.

CONTACT

For further information on this update or the Company generally, please visit our website at www.europeanmet.com or see full contact details at the end of this release.

ENQUIRIES:

European Metals Holdings Limited Keith Coughlan, Executive Chairman

Kiran Morzaria, Non-Executive Director

Carly Terzanidis, Company Secretary |

Tel: +61 (0) 419 996 333 Email: keith@europeanmet.com

Tel: +44 (0) 20 7440 0647

Tel: +61 8 6245 2050 Email: cosec@europeanmet.com

|

Zeus Capital Limited (Nomad & Broker) James Joyce/Darshan Patel/ Gabriella Zwarts (Corporate Finance) Harry Ansell (Broking)

|

Tel: +44 (0) 203 829 5000

|

BlytheRay (Financial PR) Tim Blythe Megan Ray

|

Tel: +44 (0) 20 7138 3222

|

Chapter 1 Advisors (Financial PR - Aus) David Tasker |

Tel: +61 (0) 433 112 936 |

BACKGROUND INFORMATION ON CEZ

Headquartered in the Czech Republic, CEZ a.s. is one of the largest companies in the Czech Republic and a leading energy group operating in Western and Central Europe. CEZ's core business is the generation, distribution, trade in, and sales of electricity and heat, trade in and sales of natural gas, and coal extraction. The foundation of power generation at CEZ Group are emission-free sources. The CEZ strategy named Clean Energy for Tomorrow is based on ambitious decarbonisation, development of renewable sources and nuclear energy. CEZ announced that it would move forward its climate neutrality commitment by ten years to 2040.

The largest shareholder of its parent company, CEZ a.s., is the Czech Republic with a stake of approximately 70%. The shares of CEZ a.s. are traded on the Prague and Warsaw stock exchanges and included in the PX and WIG-CEE exchange indices. CEZ's market capitalization is approximately EUR 28.2 billion.

As one of the leading Central European power companies, CEZ intends to develop several projects in areas of energy storage and battery manufacturing in the Czech Republic and in Central Europe.

CEZ is also a market leader for E-mobility in the region and has installed and operates a network of EV charging stations throughout Czech Republic. The automotive industry in the Czech Republic is a significant contributor to GDP, and the number of EV's in the country is expected to grow significantly in the coming years.

COMPETENT PERSONS AND QUALIFIED PERSON FOR THE PURPOSES OF THE AIM NOTE FOR MINING AND OIL & GAS COMPANIES

Information in this release that relates to the FECAB metallurgical testwork is based on, and fairly reflects, technical data and supporting documentation compiled or supervised by Mr Walter Mädel, a full-time employee of Geomet s.r.o an associate of the Company. Mr Mädel is a member of the Australasian Institute of Mining and Metallurgy ("AUSIMM") and a mineral processing professional with over 27 years of experience in metallurgical process and project development, process design, project implementation and operations. Of his experience, at least 5 years have been specifically focused on hard rock pegmatite Lithium processing development. Mr Mädel consents to the inclusion in this release of the matters based on this information in the form and context in which it appears. Mr Mädel is a participant in the long-term incentive plan of the Company.

Information in this release that relates to exploration results is based on, and fairly reflects, information and supporting documentation compiled by Dr Vojtech Sesulka. Dr Sesulka is a Certified Professional Geologist (certified by the European Federation of Geologists), a member of the Czech Association of Economic Geologist, and a Competent Person as defined in the JORC Code 2012 edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Dr Sesulka consents to the inclusion in this release of the matters based on his information in the form and context in which it appears. Dr Sesulka is an independent consultant with more than 10 years working for the EMH or Geomet companies. Dr Sesulka does not own any shares in the Company and is not a participant in any short- or long-term incentive plans of the Company.

Information in this release that relates to metallurgical test work and the process design criteria and flow sheets in relation to the LCP is based on, and fairly reflects, information and supporting documentation compiled by Mr Grant Harman (B.Sc Chem Eng, B.Com). Mr Harman is an independent consultant and the principal of Lithium Consultants Australasia Pty Ltd with in excess of 14 years of lithium chemicals experience. Mr Harman consents to the inclusion in this release of the matters based on his information in the form and context that the information appears. Mr Harman is a participant in the long-term incentive plan of the Company.

The information in this release that relates to Mineral Resources and Exploration Targets is based on, and fairly reflects, information and supporting documentation prepared by Mr Lynn Widenbar. Mr Widenbar, who is a Member of the Australasian Institute of Mining and Metallurgy and a Member of the Australasian Institute of Geoscientists, is a full-time employee of Widenbar and Associates and produced the estimate based on data and geological information supplied by European Metals. Mr Widenbar has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity that he is undertaking to qualify as a Competent Person as defined in the JORC Code 2012 Edition of the Australasian Code for Reporting of Exploration Results, Minerals Resources and Ore Reserves. Mr Widenbar consents to the inclusion in this release of the matters based on his information in the form and context that the information appears. Mr Widenbar does not own any shares in the Company and is not a participant in any short- or long-term incentive plans of the Company.

The information that relates to production targets for the Cinovec Lithium Project is based on information compiled by Mr Graeme Fulton, a Competent Person who is a Fellow of the Australasian Institute of Mining & Metallurgy. Mr Fulton is an Employee of Bara Consulting who are a consultant to the Company. Mr Fulton does not own any shares, options / performance rights in the Company and is not a participant in the Company's short or long-term incentive plan. Mr Fulton has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Mr Fulton consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

CAUTION REGARDING FORWARD LOOKING STATEMENTS

Information included in this release constitutes forward-looking statements. Often, but not always, forward looking statements can generally be identified by the use of forward looking words such as "may", "will", "expect", "intend", "plan", "estimate", "anticipate", "continue", and "guidance", or other similar words and may include, without limitation, statements regarding plans, strategies and objectives of management, anticipated production or construction commencement dates and expected costs or production outputs.

Forward looking statements inherently involve known and unknown risks, uncertainties and other factors that may cause the company's actual results, performance, and achievements to differ materially from any future results, performance, or achievements. Relevant factors may include, but are not limited to, changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary licences and permits and diminishing quantities or grades of reserves, political and social risks, changes to the regulatory framework within which the company operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation.

Forward looking statements are based on the Company and its management's good faith assumptions relating to the financial, market, regulatory and other relevant environments that will exist and affect the company's business and operations in the future. The company does not give any assurance that the assumptions on which forward looking statements are based will prove to be correct, or that the company's business or operations will not be affected in any material manner by these or other factors not foreseen or foreseeable by the company or management or beyond the company's control.

Although the company attempts and has attempted to identify factors that would cause actual actions, events or results to differ materially from those disclosed in forward looking statements, there may be other factors that could cause actual results, performance, achievements or events not to be as anticipated, estimated or intended, and many events are beyond the reasonable control of the company. Accordingly, readers are cautioned not to place undue reliance on forward looking statements. Forward looking statements in these materials speak only at the date of issue. Subject to any continuing obligations under applicable law or any relevant stock exchange listing rules, in providing this information the company does not undertake any obligation to publicly update or revise any of the forward looking statements or to advise of any change in events, conditions or circumstances on which any such statement is based.

LITHIUM CLASSIFICATION AND CONVERSION FACTORS

Lithium grades are normally presented in percentages or parts per million (ppm). Grades of deposits are also expressed as lithium compounds in percentages, for example as a percent lithium oxide (Li2O) content or percent lithium carbonate (Li2CO3) content.

Lithium carbonate equivalent ("LCE") is the industry standard terminology for, and is equivalent to, Li2CO3. Use of LCE is to provide data comparable with industry reports and is the total equivalent amount of lithium carbonate, assuming the lithium content in the deposit is converted to lithium carbonate, using the conversion rates in the table included below to get an equivalent Li2CO3 value in percent. Use of LCE assumes 100% recovery and no process losses in the extraction of Li2CO3 from the deposit.

Lithium resources and reserves are usually presented in tonnes of LCE or Li.

The standard conversion factors are set out in the table below:

Table: Conversion Factors for Lithium Compounds and Minerals

Convert from |

| Convert to Li | Convert to Li2O | Convert to Li2CO3 | Convert to LiOH.H2O |

Lithium | Li | 1.000 | 2.153 | 5.325 | 6.048 |

Lithium Oxide | Li2O | 0.464 | 1.000 | 2.473 | 2.809 |

Lithium Carbonate | Li2CO3 | 0.188 | 0.404 | 1.000 | 1.136 |

Lithium Hydroxide | LiOH.H2O | 0.165 | 0.356 | 0.880 | 1.000 |

Lithium Fluoride | LiF | 0.268 | 0.576 | 1.424 | 1.618 |

[1] https://miningdigital.com/news/evs-batteries-how-much-lithium-is-needed-to-decarbonise

[2] https://www.iea.org/reports/global-ev-outlook-2025/electric-vehicle-batteries / https://gycxsolar.com/understanding-lithium-content-in-a-1-kwh-battery-benefits-for-stackable-lithium-batteries-systems/#How_Much_Lithium_Is_There

[3] Price assumption of $26,000/t battery grade lithium carbonate (99.5% battery grade) based Fastmarket Global's long term forecast (Q3 2025 presentation)

[4] See DFS cautionary statement below for further details

[5] ASX/ AIM releases dated 28 April 2025 and 28 November 2025

[6] See ASX/AIM Announcement dated 26 March 2025

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.

Email this article to a friend

or share it with one of these popular networks:

You are here: news